What Manufacturers Need to Know About the EU’s CBAM ‘Carbon Tax’

Key Takeaways:

- The European Union’s Carbon Border Adjustment Mechanism (CBAM) “carbon tax” could increase some material import costs by 30%

- Proactive manufacturers are mitigating exposure to “carbon tariffs” by improving sustainability and cost with automated product design and DFM insights

The Full Article:

The European Union’s (EU) Carbon Border Adjustment Mechanism (CBAM) marks another significant step in the EU’s transition to become carbon neutral by 2050. The EU’s carbon tax is designed to level the playing field between EU companies with strict environmental rules – and foreign businesses that sell cheaper exports partially because they don’t face the same level of sustainability regulatory requirements.

Manufacturers and suppliers are beginning to feel the impact of this European Green Deal initiative. In October 2023, the EU CBAM began its transitional phase for sustainability reporting requirements. When CBAM enters into force in January 2026, EU importers will be mandated to purchase carbon certificates to ensure that they pay an equivalent carbon price as companies manufacturing in EU member states.

Proactive manufacturers are taking steps to avoid the CBAM carbon tariff by reducing carbon emissions during product design, increasing supply chain sustainability, and expanding their sustainability reporting capabilities. Read the following sections to learn more:

- What is the EU CBAM?

- Why CBAM Sustainability Reporting is a Work in Progress

- Rising CBAM Carbon Prices & Cost Implications

- How to Prepare for CBAM and Other Carbon Taxes

1. What is the EU Carbon Border Adjustment Mechanism (CBAM)?

According to the European Commission, the CBAM “will ensure the carbon price of imports is equivalent to the carbon price of [EU] domestic production, and that the EU’s climate objectives are not undermined.” This effort encourages the reduction of greenhouse gas emissions (GHG) embedded in EU imports.

And it also serves to prevent “carbon leakage”, a term for EU-based companies that move their carbon-intensive production to other countries with less stringent climate policies and a lower carbon tax. Using the carbon leakage scheme, EU manufacturers then sell their finished goods in the EU or globally while circumventing the EU’s sustainability regulations. Clearly, this strategy undercuts the EU’s climate change efforts and increases GHG pollution abroad.

The CBAM will initially only apply to select carbon-intensive materials with a high risk of carbon leakage: aluminum, cement, electricity, fertilizer, hydrogen, and iron and steel. However, there is speculation that CBAM will expand its scope to cover industry sectors including automotive and organic chemicals, according to Schroders plc and other industry observers. The CBAM is also compatible with World Trade Organization (WTO) rules.

2. Why CBAM Sustainability Reporting is a Work in Progress

During the first (and current) CBAM phase, EU companies need to report embedded emissions in their imports. EU companies will file all quarterly reports via the CBAM Transitional Registry. EU importers are required to report GHG emissions embedded during the production of aluminum, iron and steel, electricity, cement, fertilizers, and hydrogen during this period.

What to Report

The EU is developing specific reporting obligations for the CBAM transition period. While it’s important to stress that CBAM legislation may evolve, here’s a snapshot of reporting requirements from the May 16, 2023, Official Journal of the European Union and related analysis from White & Case:

- General product information: Include the name/description of the processed product (e.g., CN code), country of origin, etc. Also include the quantity of each type of good, along with associated energy consumption and weight. Specify energy consumption and weight for each factory/location that produced the goods. This includes providing the steel mill identification number for raw materials sourced

- Total emissions:

- Direct emissions: Provide CO2e emissions per megawatt-hour of electricity, or tons of CO2e emissions for each different product (The EU defines direct emissions as GHGs released “during the production of goods.”)

- Indirect emissions: Include the electricity consumption, the corresponding emissions factor, and related details. (The EU defines indirect emissions as GHGs “generated from electricity use for manufacturing, heating, or cooling during the production process.”) Note: The EU is evaluating if and how to incorporate indirect emissions (Scope 2) into its tariff calculation.

- The carbon price paid in the country of origin

How to Present CO₂e Reporting Data

During the transitional period, companies will have the choice to submit CBAM report data in one of three ways:

- Full reporting according to the new EU CBAM methodology

- Reporting based on the exporter’s national systems

- Reporting based on reference values

As part of this transition, only the EU reporting method will be accepted starting in 2025.

3. Rising CBAM Carbon Prices & Cost Implications

3. Rising CBAM Carbon Prices & Cost Implications

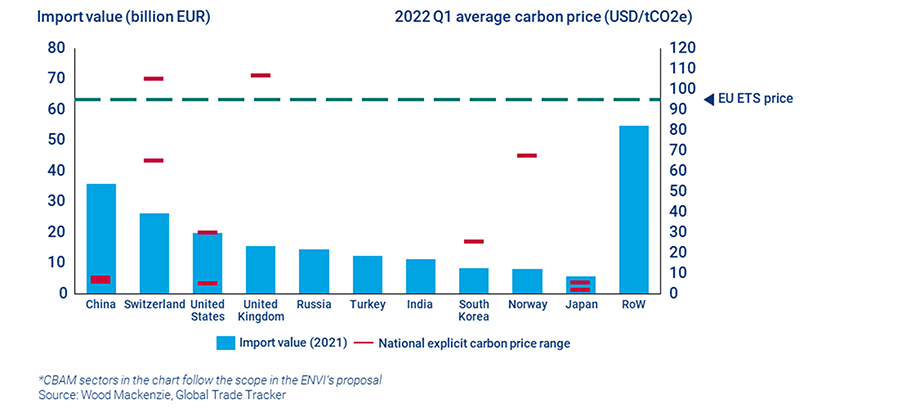

Management consulting firm BCG estimates the EU tax could increase the cost of materials made by more carbon-intensive producers, such as China, Russia, and India by 15% to 30% overnight. Let’s explore why.

Beginning in 2026, EU importers will be required to purchase “CBAM certificates” to pay the difference between the carbon price paid in the country of production and the price of carbon allowances in the EU’s Emissions Trading System (EU ETS). This approach ties the price of CBAM certificates to the average weekly price of EU ETS auctions to help streamline administration and reporting.*

This means that exports from countries with no national carbon tax – such as the United States and India – stand to pay a higher price per ton of CO2e than nations that assess a carbon tax. A country’s carbon intensity also comes into play.

A separate BCG analysis illustrates how the carbon footprint of steel producers varies by location and how steel mills are powered. Chinese steel factories, on average, emit two metric tons of CO2e per metric ton of steel. That’s 50% more CO2e than similar mills in Canada and North Korea – and twice as much as steel production in the United States and Turkey. Other countries, such as Russia, have a wide range of factories, which may require manufacturers to evaluate their suppliers’ production capabilities and carbon footprint on a regional or individual basis.

*Note: CBAM regulations will eventually phase out free allocations, allowances, and exemptions that are currently part of the EU ETS to provide additional incentives for manufacturers to reduce their carbon emissions.

Figure 1: Under the CBAM, EU importers pay the EU ETS price minus their domestic carbon (third country) GHG tax. (Click on the image from Wood Mackenzie to enlarge it.)

Carbon Prices Are Reaching Record Highs

The benchmark EU Allowances (EUAs) are the main currency in the EU’s ETS cap-and-trade system that product brands, power companies, airlines, and other industries use to pay for the carbon dioxide they emit. And the price of EUAs reached a record high of 100 Euros per metric ton of CO₂e in February 2023. EU ETS prices have risen sharply during the past few years (and doubled between 2020 and 2021). Industry observers and financial analysts expect this trend to continue due to increasing demand spurred by efforts in the EU and elsewhere to reduce carbon emissions.

Figure 2: The price of permits on the European Union’s carbon market is projected to steadily increase and trade at 103.73 EUR within the next 12 months, according to projections by Trading Economics. (Click on the image to enlarge it.)

4. How to Prepare for CBAM and Other Carbon Taxes

The EU CBAM highlights the pivotal role that sustainability plays in determining short-term profits and long-term competitiveness. Following the EU’s lead in decarbonization efforts, the United Kingdom (UK) also announced its own CBAM. UK leaders are scheduled to finalize its scope and framework at the end of 2024, and the UK CBAM will enter into force in 2027. Other countries are also evaluating new mechanisms to regulate and incentivize lower-emission imports.

Successful manufacturers are incorporating sustainability into their product design, sourcing/supply chain, and manufacturing strategies. This enables manufacturers to understand a product’s CO2e impact during early design phases and then evaluate opportunities to reduce a product’s environmental impact based on design, materials, manufacturing process, and factory location.

aPriori provides real-time insights for product development teams to measure, reduce, and help to report on their products’ carbon footprint during product design and production. By adding CO2e emissions data, aPriori provides the only manufacturing intelligence platform to optimize products for cost, manufacturability, and sustainability in real time.

Product development teams use aPriori’s trade-off analysis to compare designs, materials, and processes for sustainability. For example, our manufacturing process models enable teams to explore cost and CO2e (energy) savings down to the machine level.

Additionally, we have nearly 90 regional data libraries (aPriori RDLs) that enable teams to benchmark production capabilities and typical manufacturing costs. For example, sourcing teams can use aPriori RDLs to simulate production costs and carbon among factories in Chengdu, China; West Bengal, India; Northern Mexico; and Taiwan.

And with our digital factory twins, you can create a digital replica of a supplier factory or in-house production capability down to individual machine/plant specifications.

aPriori’s bottom-up overhead model provides detailed energy consumption (and cost) estimates, which is essential to evaluate the financial impact of CBAM and other carbon tax schemes globally. Specifically, aPriori provides estimated energy costs based on the energy consumption required to run machines and regional electricity rates.

Use aPriori to answer product development sustainability questions quickly and confidently, including:

- How can I meet my profitability and sustainability targets?

- Which components have the highest carbon footprint in my product(s)?

- How will a proposed design change impact direct and indirect carbon emissions?

- Which manufacturing methods/processes have the highest energy efficiency and produce the least waste?

- How will the factory location affect product sustainability?

Learn why small gains aren’t enough for EU manufacturers today, and get 6 strategies for success.

Get aPriori's Exclusive Guide to Reducing Product Emissions