How to Conduct a Spend Analysis: Methodology in Detail

Key Takeaways:

- Use our seven-step process to conduct a detailed spend analysis

- Take advantage of our tips for procurement teams to unlock additional savings

The Full Article:

Conducting a spend analysis is an essential cost-saving component in any business, and it is especially important in the manufacturing industry. We cannot fully consider cost-saving opportunities until we have visibility into our product manufacturing spend today.

Experienced procurement and sourcing managers who conduct a spend analysis to meet product cost reduction goals typically achieve savings of 3% to 5% of the spend analyzed.

Procurement teams that achieve optimum savings have a robust strategic sourcing and procurement process to review material and component spend categories to meet product cost reduction goals. This includes working through each manufacturing process to identify outliers, analyze those outliers, and execute cost-reduction initiatives.

Discover what is the spend analysis methodology for manufacturers. Additionally, learn how procurement teams can use detailed spend analytics to streamline processes, capture cost savings, and advance strategic sourcing to help increase profitability.

What Is the Spend Analysis Process in Manufacturing?

The spend analysis process involves collecting, cleansing, classifying, and analyzing spend data. The result? Organizations can cut procurement costs, improve efficiency, enhance supply chain management, and monitor controls and compliance.

Manufacturers use spend analysis to review all their purchases and identify the best opportunities to save time and money by renegotiating costs with suppliers or redesigning products. Spend analysis not only helps companies reduce the cost of existing components (VAVE) but also lowers manufacturing cycle time by streamlining sourcing decisions.

As a sourcing manager, the primary driver for conducting a spend analysis is to meet your cost-reduction goals. A spend analysis helps you achieve those goals by identifying cost outliers – the most promising parts on which to focus your cost reduction efforts.

After conducting a manufacturing spend analysis, you should be able to identify:

- The specific parts for which you may be overpaying and an estimate of how much

- Products that could be redesigned for cost reduction

- Items that are not being made most cost-effectively, i.e., via the most cost-effective routing or process

- The number of suppliers that may be a better fit for the parts that you are buying

Moreover, the spend analysis process enables manufacturers to align their procurement and product design teams, often leading to fewer design iterations and reduced costly engineering change orders (ECOs).

The Manufacturing Spend Analysis Methodology

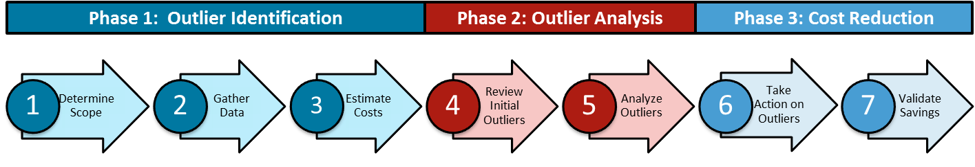

We recommend the following methodology for a procurement spend analysis, which has three phases and seven main steps.

Phase I: Identify Outliers — Spend and Sourcing Analysis

A standard product cost outlier is a part for which the price difference between what your product cost management platform estimates it should cost and what you pay is more than 20%. Identifying these products is the core of phase one of the manufacturing spend analysis and spend management process.

1. How to Determine Spend Analysis Scope

You likely have thousands of parts that you buy and simply cannot examine all of them at once. That’s why it’s important to narrow down the scope of what you’re going to analyze.

- Procurement teams start by segmenting your spend into manufacturing process groups, such as sheet metal or casting parts, and then further categorize by material. You may not be able to determine the material of your parts until you look at the actual 2D drawings or PDFs. But if you can, segment them by material at this stage, as this will allow you to determine design outliers.

- Next, go to your ERP system and get the current price that you’re paying for the part and the estimated volume for each part annually. Multiply the two to determine how much you spend on each one of these parts. EQUATION: Current Price of Part x Estimated Volume of Part = Product Spend.

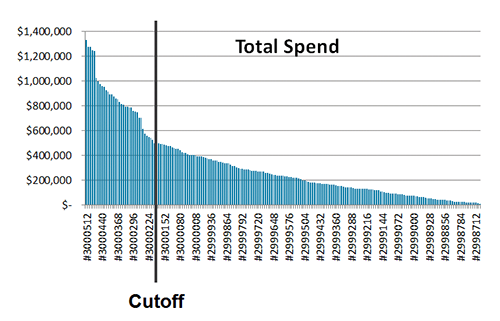

- Then, add the total spend to a Pareto chart with all the parts that you are analyzing. Once your parts are in the chart, select the top 50, 100, or 200 parts to analyze. It’s up to you where you make the cutoff, but you want to prioritize based on the highest annual procurement spend. By pinpointing high-spend components, you can make rapid, more informed design and sourcing decisions that reduce time to market (TTM) and accelerate cash flow generation.

The Pareto chart shows the top 100 products by total product cost. Additionally, business intelligence tools, including aP Generate, provide a dashboard view of product cost outliers at scale.

2. Gather Important Spend Analysis Data

Once you have narrowed the scope down to your top 50 to 100 parts, begin to obtain the data for these parts. Data to gather includes:

- 3D CAD models

- 2D drawings, usually in PDF format, which may contain data not found on the model (such as material type or secondary processes required and tight tolerances)

- The actual or estimated, forward-looking annual production volume for each part

- What you currently pay for each part – pulling purchase order (PO) history may help here

- And the estimated batch size. If you don’t have the batch size, then use the order size from your ERP system or assume monthly batches

If you were not able to segment by material type when determining your scope, having gathered the 2D drawings, you may now be able to do so. You will need to know the material to estimate the cost of the parts properly.

PRO TIP: You also want to collect the manufacturing process used to make the part today (if known) and the name of the supplier making the part. You will need to know which supplier is making the part if you want to do some extended trend analysis later.

In addition, you will want to know the location where you’re buying the part. When you generate the estimated cost, don’t compare the cost of a part that you buy in China, for example, to the estimated cost of making that component in the U.S.

3. Estimate Should Costs and Identify Outliers

At this point, you’ve determined your scope of review and gathered your important data pieces.

The next step, and one of the most critical, is to estimate the costs of your 100 parts. You can do this with whatever tool you have available, whether it’s a set of complex Excel spreadsheets or aPriori’s real-time, AI-powered design & sourcing insights software for manufacturers.

PRO TIP: Use automation to save time on your estimates! An AI-powered manufacturing insights platform enables manufacturers to optimize products for cost, sustainability, and manufacturability simultaneously. One feature–commonly referred to as cost/spend analysis software–uses both global and highly localized product cost inputs to help businesses estimate the should cost of their products.

Using aPriori’s automated insights, manufacturers have the visibility to optimize the product process to capture additional savings, reduce carbon emissions, and address supply chain risks proactively. And it does so at a fraction of the time of custom spreadsheets. aPriori ensures that you have actionable insights to improve your cost-based business decisions.

Once you have estimated the cost of your parts, you will be able to identify the outliers by conducting a should cost analysis. A should cost analysis involves comparing your should cost estimate to what you’re actually paying and then identifying parts where the gap is significant.

Across all industries, a standard product cost outlier is a part for which the price difference between what your product cost management platform estimates it should cost and what you pay is more than 20%.

However, your outlier percentage may be different. I recommend that you calculate the annual potential savings (potential savings multiplied by annual volume) per part and prioritize based on that figure and the percentage difference.

There may be parts for which the difference is high—you are paying a lot more than you should—but the annual savings may not be sufficient to take action. Likewise, there may be parts where the annual savings seem promising, but the percentage difference is low and likely to evaporate during negotiations.

Phase II: Outlier Analysis

The next phase involves reviewing the outliers you have identified and beginning to select those where you have cost-saving and negotiating opportunities.

4. Review Initial Outliers

After identifying your initial outliers, which may be 20-25 out of your original scope of about 100 parts, you want to re-review the estimate for each part to ensure you have accurately forecasted the product cost.

This is an important step because you don’t want to move forward with the next steps if the data that you have is not valid.

If the gap is significant, meaning the estimate is 3 to 4x lower than what you’re paying, this step becomes especially crucial. Spend time reviewing your selected materials, volumes, manufacturing processes, etc. For example, have you excluded the cost of shipping from the supplier price? We want to concentrate on the part cost.

5. Analyze Your Outliers and Plan

After confirming the accuracy of estimates, analyze your remaining outliers in detail to determine the best possible method for cost savings and develop an action plan for each.

There are two key areas of outlier analysis: Redesign and Renegotiation.

Identifying Candidates for Redesign

To identify candidates that may be a good fit for a redesign to save costs, first plot the estimated cost of each part divided by its weight.

EQUATION: Estimated Cost/Product Weight = X

Weight can be obtained from your cost-estimating software, the 3D CAD system if it has density, or the estimated shipping weight from your ERP.

Plot these points on a scatter plot. You may notice that your scatter plot aligns into a straight line. Identify the parts for which the ratio of weight to estimated cost is very high relative to the rest. This is an indication that the part is complex or has high tolerance requirements. Note: aPriori’s enterprise-quality reporting solution, aP Analytics, offers out-of-the-box (OOTB) reports that will plot this for you.

As you plot, ensure that you prioritize candidates for supplier discussion based on the highest annual spend or greatest savings opportunity. The goal is to engage the supplier in suggesting redesign ideas or, if the difference was just price, reducing the cost. For example, you might say, “I noticed that this part costs a lot more relative to its weight than others like it. Can you help me understand why?” If there is a design or manufacturing reason, the supplier is likely to bring it up.

Identifying Candidates for Renegotiation

If the difference between your current cost and your estimated cost is significant, say 20% or more, then a discussion regarding how the supplier arrived at that price is in order. The OOTB reports from aP Analytics automatically calculate and plot the percentage difference between the estimated cost and your current price. These reports also simultaneously plot what the potential savings would be if you realized it all.

Key areas where you may see cost negotiation opportunities are:

- Material costs

- Tooling costs

- Manufacturing routing techniques

- Cost of making the parts

Understand the cost estimate, where the cost is going, and what drives most of the cost. Then, develop a list of questions that can be used for effective supplier negotiation and collaboration. Check out these tips for collaborating with your supplier using fact-based negotiation.

Phase III: Cost Reduction

6. Take Action

Once you have completed your outlier analysis, it’s time to do something about it.

For Redesign Opportunities:

Take the part that you want to redesign or explore a redesign of and go to engineering to discuss redesign and its cost-saving potential. Alternatively, you can speak with your suppliers to see if the part can be redesigned to better fit with the manufacturing process.

PRO TIP: From personal experience, I can tell you that if you go to your suppliers and simply ask them for ideas on how to save money on all the parts they manufacture for you, you may get general suggestions that are very seldom worth pursuing. However, if you do the work to run an informed spend analysis and then go to your supplier and say, “Hey, I have one or two parts that I think there is an opportunity for us to collaborate on to make it cheaper,” they will be very happy to look at those one or two parts in detail, giving you targeted suggestions for reducing costs. This has been a worthwhile exercise for many of our customers.

For Renegotiation Opportunities:

If the part is too expensive, you need to develop a plan for approaching the supplier based on the data from the analysis and then renegotiate the costs with the supplier. Even if the product can’t be redesigned to save, there may be opportunities to save in areas like expensive premiums or tooling. The basic premise is to identify the major difference between the supplier’s estimate and yours, determine the root cause of that gap, and collaborate with the supplier to resolve it. In my experience, asking the supplier to “help you understand” the difference instead of right out challenging the difference yields better results.

7. Validate Your Savings

Finally, you need to validate your savings. See if what you estimated as potential savings (the difference between your should cost estimate and what you were actually paying) was realized and how much of it was realized. You can leverage mutually beneficial, fact-based cost data to enhance supplier relationships and score cost-saving wins during negotiations.

Does this really work? Yes, it does!

As an example, we worked with a $6.5B manufacturer and supplier of commercial trucks, parts, and diesel engines. They wanted to accelerate the achievement of annual cost-reduction goals. We analyzed €7.7M in spend across 86 sheet metal parts. Seventeen of the 86 parts turned out to be outliers. At the end of the exercise, the manufacturer had confirmed savings of €1.6M, which was 20% of the spend analyzed.

Strategic Sourcing Optimization for Cost Transformation

A robust sourcing strategy requires more than a spend analysis to identify costs. It also requires a should cost analysis to identify cost outliers, which can help sourcing teams prioritize components and raw materials that require additional investigation and negotiation to secure lower prices. However, for true cost transformation that will have staying power, procurement needs a solution that drills down to the highest component cost drains.

How to Revolutionize Cost Engineering with 3D CAD Precision

Discover the path to increasing cost estimation speed and accuracy with automated solutions.