A Guide to Should Cost

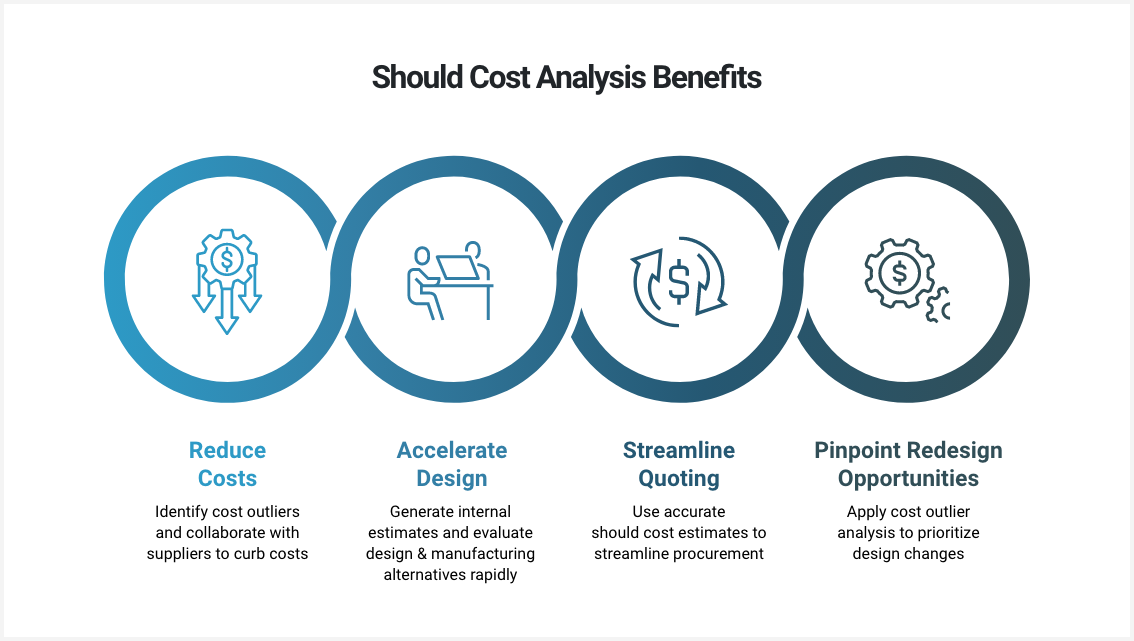

This guide provides an overview of should cost analysis — a methodology for calculating accurate cost targets for purchased products. These cost target benchmarks provide an essential foundation for more effective, fact-based supplier negotiations to reduce costs, accelerate time to market, and foster smarter designs.

Should cost analysis, also known as cost breakdown analysis, examines costs at a granular level and then adds up all costs to establish an accurate “should cost” of manufactured products. Should cost analysis applies a “bottom-up” methodology to analyze all materials, processes, and service costs for production. By contrast, a “top-down” approach relies on previous estimates (or manufacturing orders) as the baseline cost for new orders or initiatives.

Download this guide to read on the go.

An effective cost estimation model is essential for optimizing your products and your supply chain in today's global marketplace.

What Is Should Cost?

A should cost estimates the total cost to produce a component, assembly, or product based on efficient manufacturing and distribution practices, and current market costs (which can fluctuate due to global inflation of material costs, regional labor rates, manufacturing process, machine types, and more).

An effective should cost methodology accounts for material costs, labor rates, overhead costs, batch sizes and production volumes, manufacturing supplier profit margins, and other production factors.

The Real Meaning of Should Cost: A Strategic Benchmark for Cost Engineers

For manufacturers, having a should cost along with detailed manufacturing process data helps:

- Source components more strategically.

- Anchor supplier negotiations in quantitative data and manufacturing knowledge.

- Estimate and model procurement costs for new designs without waiting for supplier quotes.

The Meaning of Should Cost vs. Will Cost

“Will cost” is what components will actually cost to procure—reflecting actual, rather than optimally efficient, production conditions.

Cost engineers almost always expect some sort of margin between the “will” and “should” cost—few if any suppliers have optimized every aspect of their entire cost structure. But the size of the margin provides a valuable point of comparison between potential suppliers. And should costs may constitute a long-term goal for supplier cost reduction when negotiating contracts.

Why Should Cost Targets Are Inherently Imprecise

A product’s underlying cost drivers can be quite complex, and any should cost model is attempting to calculate projections for market-driven costs that can change by the day. Anything from a change in the price of steel to a new union contract for welders halfway around the globe can suddenly and dramatically alter a product’s current cost.

Despite this imprecision, robust should cost models still provide real value as a point of comparison, especially since actual supplier quotes can be wildly imprecise to begin with. If the same part specification is sent to three different suppliers, we often expect a variance in quotes of +/-40%.

When this scale of imprecision abounds, a quality model of efficient cost offers a key anchor for supplier cost optimization efforts.

You can read more about the inherent imprecision of should cost projections in our insightful article.

Managing Should Cost

To benefit from the value of robust should cost models, product cost engineers must commit real time and resources to supporting rigorous should cost analysis.

Analyzing the myriad cost drivers behind a product is a complicated analytical task that needs to be supported by skilled cost engineers, carefully prioritized to target the most salient component-level cost drivers, and conducted as fast as possible to facilitate the fastest possible time to market for new products.

Below, we dive into some practical details of effectively conducting should cost analysis, leveraging the intelligence it generates, and using this information to collaborate with suppliers to reduce costs.

Prioritizing Cost Reduction With Spend Analysis

In manufacturing, a “spend analysis” is the process used to analyze purchases to prioritize cost-reduction efforts. By quantifying component and other input costs, outliers can be targeted for negotiation, re-sourcing, and/or re-engineering.

Many engineering organizations are using hundreds of thousands of different components across many different designs. Conducting a thorough should cost analysis of every one of these components and renegotiating their purchase price would never be practical. For parts used only a handful of times, the should cost analysis itself may cost more than any cost savings achieved.

A spend analysis looks at which functional categories are driving the most spending. In these areas, achieving even a small marginal cost reduction may result in substantial dollar savings.

How to Conduct a Spend Analysis

Should Cost Negotiation: Leveraging Should Cost Analysis

What Is Should Cost Negotiation?

The more detailed, accurate, and actionable a should cost estimate is, the more value it provides in a supplier negotiation.

Should cost negotiations are closely related to the concept of fact-based negotiation. We can think of should costing as an instrumental process for developing the “facts” upon which these negotiations are centered.

We provide an overview of these approaches below. For more detailed information, we recommend our blog on fact-based negotiation.

What Is Fact-Based Negotiation?

Fact-based negotiation is the practice of focusing supplier negotiations on mutually beneficial data on cost structure rather than gamesmanship.

The Key Role of the Manufacturing Cost Modeling Software In Fact-Based Negotiations

Generating actionable factors on suppliers’ product costs requires detailed insight into underlying factors including:

- Material Costs/Manufacturing Process Costs

- Labor Costs

- Overhead

- Tooling/Facilities Investments

Calculating how these factors interact to contribute to a component’s ultimate cost structure is a very complex analytical challenge. A tweaked materials selection, for instance, may require a different manufacturing process only available at a different manufacturing facility with far higher rental and transportation costs.

The right manufacturing cost modeling software makes it far easier to generate detailed insight into cost structure that can impactfully inform supplier negotiations.

The Role of Digital Manufacturing Simulation

The most effective manufacturing cost modeling software, like aPriori, will employ digital manufacturing simulation to generate should cost models. Ideally, in this approach, this software directly analyzes 3D CAD files to generate a digital twin of the part or product being modeled. It can then simulate production using a digital factory to generate in-depth insights into manufacturability. These simulated cost models can account for virtually every aspect of a product’s cost structure, including materials, tooling, labor, production facilities, and more.

Digital manufacturing simulation is hugely valuable for navigating the complexities discussed above. For more on this software, see the section on manufacturing cost estimation modeling software below.

With this sort of insight in hand, a supplier negotiation can be transformed from, “This cost is too high” to, for instance, “Could you use a laser for this operation instead of stamping?”

Tips for Framing Your Negotiation

A few sample phrases can be helpful for conceptualizing how to use should cost insight to propel more fruitful negotiations.

“Our simulation suggests this part could be over 50% cheaper. How close can we get to that target? What aspect of our design is driving this discrepancy?”

“Our cost model suggests there’s a cheaper production method available for this component than the one you’re currently utilizing. Can we establish a timeline for shifting production/price to this approach?”

How Procurement Teams Can Collaborate With Suppliers to Reduce Cost

The long-term goal of the should cost negotiations described above is not just to reduce component cost directly but remove adversarial negotiations in favor of a cost-reduction collaboration with suppliers. Detailed should cost estimates help move away from “accusing” a supplier of having a price that’s too high and toward investigating why the price is so high.

By moving away from arbitrary cost-reduction targets and toward a collaborative negotiation approach, suppliers are incentivized to work with you to bring down costs over time. As more supplier relationships become integrated with this approach, components can be sourced from the supplier that has the most efficient production capability (as opposed to the supplier who happened to make the most aggressive quote).

How Should Cost Modeling Software Accelerates Quoting

Manufacturing Cost Modeling Speeds Up Product Development Timelines

Suppliers can take weeks to return quotes. This timeline is often unacceptable when bringing a new product to the market. Digitally simulated should cost models allow design engineers to generate robust projections for what a component should cost to acquire without waiting for suppliers. This dramatic improvement in time efficiency allows engineers to consider and model multiple design alternatives in the time it would take to wait for a single quote.

While the final design’s supply needs will still ultimately need to be quoted, the capability to compare design alternatives without waiting for supplier quotes can substantially accelerate time to market for product development initiatives.

Similarly, when customers request quotes, should cost models allow for more rapid return of a far more accurate price—often streamlining the quoting timeline from weeks to days.

Finally, when re-designing to eliminate a cost outlier component, engineers no longer have to guess if they’ve uncovered all the relevant inefficiencies. Should cost models provide a handy goalpost for re-engineering cost.

What To Look For in Manufacturing Cost Modeling Software

The right technology tools are an essential part of a rigorous should cost analysis process.

If it is not rooted in quality, consistent, manufacturing cost models, a should cost target becomes just another arbitrary cost-cutting goal.

In addition to working far faster than manual, Excel spreadsheet-driven should costing processes, advanced cost modeling tools provide detailed insights into the actual factors driving costs within the design itself.

The Value of Should Cost Modeling Software

The most effective should cost modeling software offers detailed cost analysis based on digital manufacturing simulations of different manufacturing processes. As discussed above, a robust model needs to account for factors ranging from logistics to materials to labor costs.

These factors can be related in ways that are difficult for even an experienced product engineer to anticipate without a detailed manufacturing simulation. An otherwise inexpensive part may have a cooling requirement that dramatically lengthens the production process. The marginal cost impact of a new routing may hinge on production volumes as capital investment in machinery is averaged over more and more units.

Digital manufacturing simulation software like aPriori can detect these often powerful and unintuitive cost interactions through analyses that run in a matter of minutes, quickly highlighting problem areas and even automatically suggesting alternatives.

Beyond Should Cost: Manufacturing Cost Modeling for Product Design

Digital manufacturing simulation generates actionable Design for Manufacturability (DFM) and Design to Cost (DTC) insights that help product engineers integrate cost modeling directly into the design stage of product development. This integration provides the ability to compare alternative designs on the fly to identify the lowest cost possible to achieve market-driven form, fit, and function demands.

Manufacturing Cost Modeling Software That Works at the Design Stage

This software needs the right feature set to be effective without bogging down designers or inhibiting innovation.

The most impactful manufacturing cost modeling software needs to:

- Employ digital manufacturing simulation based on direct analysis of 3D CAD files, allowing engineers to quickly cost alternatives as they explore design options.

- Feature digital manufacturing simulation that covers a wide array of specific manufacturing processes.

- Be fully customizable to reflect your production environment/supplier specifications.

These capabilities are important because well over half of a product’s total cost becomes baked in once its design is set. Should costing negotiations are a great approach for reducing product costs, saving money even on designs that are already finalized—but bringing in the same cost modeling capabilities while a product is still being designed unlocks even more potential savings.

For a deeper look at what to look for in manufacturing cost estimation software, please read our comprehensive article on this topic.

Case Study Examples: Should Cost Analysis Saves Manufacturers Millions

aPriori is used by manufacturers and procurement leaders to generate cost models that help build better products, anchor collaborative supplier relationships, and accelerate time to market. Read our three should cost case studies below, and check out our full list of case studies to learn how manufacturers are using aPriori to gain value.

TE Connectivity: Supplier Relationship Management Strategy Drives Savings

Managing the manufacturing supply chain in the face of inflationary pressures and global disruptions poses a significant challenge for manufacturers. To overcome these obstacles, companies like TE Connectivity need to collaborate effectively with all stakeholders and harness the power of actionable, real-time manufacturing data.

This approach is crucial for successful supply chain management, cost mitigation, and making informed procurement and sourcing decisions for a competitive advantage.

In this case study, discover how TE Connectivity uses aPriori’s data-driven cost analysis to improve bottom-line outcomes and drive innovation through efficient supplier relationship management (SRM).

GE Appliances: Should Cost Models for Systematic Cost Management

Discover the transformative outcomes of GE Appliances’ journey with aPriori, highlighting the manufacturer’s four-step change management approach to effective should cost implementation.

This case study explores the challenges, strategies, and results achieved by embedding a should cost analysis tool within the organization.

KONE: Developing a Robust Should Cost Analysis Strategy

Today’s elevator industry is presented with unique challenges, including multiple variations of products, custom and low-volume products, global and regionalized safety codes, and repeatability for scaling. These obstacles made should costing difficult to scale for many organizations.

KONE’s should costing methodology was outdated, lengthy, clunky, and inefficient until they adopted aPriori to streamline their should costing efforts. With aPriori, KONE can now develop a should costing strategy that can grow with their business.

Learn more about how KONE uses aPriori to enhance their entire should costing methodology.

AGCO: Precision in Action – Internal Factory Costing

AGCO is a global designer, manufacturer, and distributor of agricultural equipment. They’re a global and highly trusted presence for farmers around the world. Their full range of machines and equipment includes planting, harvesting, tending, storing, feeding, and smart farming innovations of the future.

AGCO needed a solution to get fast, accurate product cost and should cost insights to make decisions that benefit the business. The organization now leverages aPriori as a formal, controlled method to accept or validate final part costs.

Learn more about how AGCO leverages aPriori to improve their part cost analysis.

aPriori Provides Actionable Insights for Better Manufacturing

aPriori is the leading provider of digital manufacturing simulation software. By leveraging the digital twin with our digital factories, we automatically generate insights for profitability, manufacturability, and sustainability to help manufacturers collaborate to make better design, strategic sourcing, and manufacturing decisions that create higher-value products in less time. aPriori works with manufacturers to bring automated simulation into the design process to save time, reduce costs, and achieve their sustainability goals.