What’s a Reverse Auction, And When Should Manufacturers Conduct Them?

Key Takeaways:

- Use reverse auctions to identify the right supplier fit without compromising relationships across the supply chain

- Procurement teams can employ a cost-estimating tool to set accurate bid prices and group parts that should be bid together on the same package

The Full Article:

Reverse auctions have garnered a reputation for putting suppliers at a disadvantage – partially because they have been used like a blunt tool for nearly every procurement situation. However, when used strategically, reverse auctions can still deliver significant savings in specific cases without tarnishing supplier relationships.

In a reverse auction, a buyer invites multiple suppliers (sellers) to bid against each other to provide a product or service. The buyer then awards the contract to the seller based on factors such as bid price. Manufacturers use reverse auctions as a competitive procurement strategy to select the most appropriate supplier.

In contrast, traditional auctions use the opposite model: multiple buyers bid on a single good or service from a seller. Bidding in traditional/forward auctions drives up the final sales price for the seller.

Check out the following sections to guide you through the concept and applications of reverse auctions:

- 4 Use Cases for Reverse Auctions

- Grouping Parts for Reverse Auctions: A Critical Component to Get the Right Price

- Reverse Auction Examples

- 6 Helpful Tips for Conducting Successful Reverse Auctions

- Take a Strategic Approach to Reverse Auctions

4 Use Cases for Reverse Auctions

Strategic reverse auctions that offer fair starting prices and prioritize long-term partnerships can benefit the buyers and suppliers. Manufacturing sourcing teams Should use a reverse auction during any of the following four circumstances:

1. The Current Supplier Can’t Produce the Part in an Effective Manner

When a supplier is inefficiently making a part, they are typically making far less profit than they like. A manufacturer, in this example, needs to source a high-volume component that would be best produced using a medium-sized automatic sand-casting process and a 4-axis machining center.

The current supplier only has a manual floor line and limited 3-axis machining capabilities. Because of this, the supplier outsources the sand-casting operations and performs the machining with more set-ups, which reduces its margins in these areas. In this case, offering the part in a reverse auction would benefit the buyer, the current supplier, and any future potential supplier.

Buyers can gain insight by using a cost-estimating tool that indicates the most appropriate equipment to produce this part and provides an updated target price for the auction. With this information, the buyer can invite better-qualified suppliers to the reverse auction. Only suppliers that have the right equipment will be invited to this auction, resulting in an optimum price.

2. The Buyer Knows the Cost but Doesn’t Have the Capacity to Make it

In this scenario, we are assuming the buyer has already decided to purchase a specific part that they are currently making in-house. No supplier is currently producing the buyer’s part, so there are no existing orders to be lost. The future supplier will gain an order. This is a typical “make vs. buy” situation.

Because the buyer already has the should cost to make this part, the goal is to beat their own internal cost. In this case, a reverse auction can become a competition, where the buyer sets a reserve/cap at their current cost. Inviting only the right suppliers with the required capabilities is the best way to ensure they can successfully compete. Imagine the following scenario:

A supplier is repeatedly invited to a particular buyer’s reverse auctions, even though that supplier is never quite suited to make those parts economically. The supplier repeatedly loses the auctions and decides to bow out of the next invitation (when, in fact, this was the one part this supplier was suited for).

The procurement team may inadvertently assume that the supplier keeps losing because they are too expensive. However, the true reason is that the supplier is bidding on parts that are outside their capabilities and functions. This could have massive ramifications on buyer-supplier relationships.

3. The Buyer Wants to Find a Second Source for Specific Parts

The buyer makes a business decision to identify a second source to mitigate future risk, so the current supplier is going to have to share the spend, and the future supplier will gain an order.

Ensuring that the invitees to the reverse auction have the right equipment and sufficient capacity to make the % of volume the buyer wants to “split” is important to get an optimum cost with a low delivery risk.

4. The Buyer Wants to Aggregate Similar Parts to Get a Volume Discount

In this case, there will be both winners and losers, but all current suppliers have an equal chance of gaining more volume. The buyer compiles low-spend parts and aggregates them together in one bid package. While some suppliers may lose a little volume (these are, after all, low-spend parts), a few of them will earn themselves a large chunk of spend. This approach involves some risk-taking for the suppliers, but it is a fair business practice.

Grouping Parts for Reverse Auctions: A Critical Component to Get the Right Price

There are times when it may be convenient and profitable for a buyer to purchase parts as a group. For example:

- A particular product has a dozen plastic parts, and the rest are metal components, or vice versa. The team decides that purchasing all the plastic parts as a group could be beneficial, but does it make financial sense? Would it be better to split them into sub-groups? If so, how?

- The buying team believes that a group of parts is overpriced; however, because they are purchased in low quantities, it doesn’t seem worth the time to renegotiate them individually. How would the team go about grouping these parts to get the best price?

- The buyer decides to conduct a reverse auction, which encompasses a collection of parts. What is the best way to define each lot to get the best price?

Reverse Auction Examples

The following two reverse auction case studies illustrate how a real-time cost-estimating tool can help buyers make these decisions.

Example 1: Automotive OEM Sources 15 Injection Molded Plastic Parts

An automotive buyer sends out a request for quote (RFQ) to four suppliers. The RFQ is for 15 injection-molded parts that range in size from parts that fit in a 3”x2”x2” cube to parts that require a 24”x12”x10” cube to fit into. Most of the parts vary in thickness and may be made of different materials.

A cost-estimating tool could help the buyer determine whether the RFQs should be split or grouped by required material types, part sizes and complexities, and volume quantities. By assessing these factors, the cost-estimating tool can generate insights into the most cost-effective approach for splitting or grouping the RFQs.

The tool can identify the equipment necessary to make each part and help determine the approximate cooling time of each part. The 15 parts differ in size, thickness, and material. Therefore, the equipment necessary to make them can vary widely. The small parts may only require a 100-ton machine, while the larger parts may require a 400- or 600-ton machine.

But in this example, the buyer sent this RFQ to four suppliers without using a cost-estimating tool and without the knowledge gained regarding the equipment by using one. Details regarding the four suppliers are:

- Supplier A has a wide variety of equipment, from 100-ton to 800-ton machines

- Suppliers B and C have only small equipment (200-ton machines and smaller)

- Supplier D has only large equipment (400 tons and higher)

In this case, Suppliers B and C will have to outsource the larger parts and increase their cost as they are subbed. Similarly, Supplier D will have to outsource the small parts, or worse, make them in a larger machine than necessary, increasing their cost dramatically. The only supplier in this group that can provide a competitive quote is Supplier A; therefore, there is only one viable quote.

Evaluation and Selection:

Utilize the cost-estimating tool, which provides the machine’s size requirements. Then:

- Group the parts by similar machine sizes (e.g., < 200 – 400 tons; > 400 tons)

- Send the RFQ packages to suppliers with the right machine sizes and sufficient capacity to make each group of parts

- Receive multiple truly competitive quotes for each grouping

Bonus: By cost estimating each group (package) ahead of time, there is a target cost for the package to which to compare the RFQ responses.

Example 2: Aerospace Engine OEM Requires 25 Sheet Metal Parts

An aerospace engine manufacturer’s sourcing requirements include 25 miscellaneous sheet metal parts (brackets and frames). Each part represents a small amount of spend, roughly $20,000 per year. But in aggregate, these parts represent $500,000 in annual spend. An average 20% cost reduction among these parts would yield $100,000 in annual savings. In this example, selecting the right groupings is again important to optimize cost.

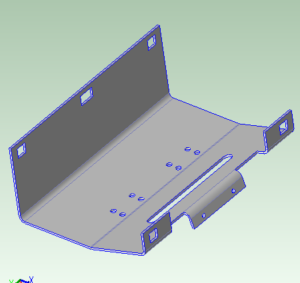

One of the brackets (Image 1) has a complex perimeter with four round holes and one bend. A laser and a simple bend break can best make that bracket. If a supplier with mostly turret presses and fancy robotic bend breaks quotes on that bracket, then the cost may be unnecessarily high. However, suppose that bracket was more complex, with multiple internal cut-outs and several bends like the one below. In that case, it may be better suited to a supplier that has a fast turret press, fiber lasers, or robotic bend breaks.

Image 1: Bracket with complex perimeter

A cost-estimating tool that indicates the best routing for each part helps the buyer group the 25 sheet metal parts into two or three groups. These groups (packages) can be sent to the suppliers with the correct capabilities so that each RFP/RFQ is optimal from the start. This enables the buyer to achieve maximum cost savings from as little negotiations as possible without overtaxing the suppliers.

Without knowledge of the cost-estimating tool, the buyer sends all 25 parts out for a quote on one RFQ package. The lowest total quote contains a mix of individual parts that are individually quoted lower by other suppliers. In this case, the buyer is not getting the lowest total quote by group. Selecting and grouping the right parts in one reverse auction package is critical to getting the best price for the lot. Buyers cannot cherry-pick which parts they buy from one supplier or another. The winner of the lot gets all the parts, and the discount is based on aggregated spend.

6 Helpful Tips for Conducting Successful Reverse Auctions

- Establish your goals and strategy

- Use live reverse auctions to find and meet new suppliers. A live event also allows the supplier to see the parts physically, ask questions live, and even provide valuable design for manufacturing (DFM) feedback to your buyers.

- Do not promise 100% of the EAU to the winner

- Promise up to 80%

- Reserve 20%

- Keep two suppliers for each part

- There may be reasons other than money to keep a second source. For example, the buyer may need a supplier that is close to the plant to fill emergency requirements.

- Provide transparency and plan accordingly

- Have all required information available and sent ahead of time.

- Set up a pre-auction conference call to answer questions

- Keep a running list (easily accessible to all suppliers) of FAQs for each bid package

- List the capabilities believed to be required to make the part. State that not all of them need to be in-house

- If possible, state estimated capacity requirements (yearly or by order quantity) for each critical piece of equipment to avoid delivery risk later.

- Let bidders know ahead of time if there are potential difficulties with your part to avoid scrap and reworking later.

- For example, if a low-volume sheet metal part has a hole that is close to a bend, the hole may deform when making the bend. Depending on the proximity, material thickness, and other factors, the supplier may have to machine or punch the hole after the bend is made (extra process). If the supplier misses this, the buyer will get quality issues from the start, and the supplier may want to increase the price after the issue is resolved.

- Consider how to group your parts and components

- Parts may be sent out to auction individually or in related groups (have similar manufacturing requirements). Suppliers must bid on all the parts in the set.

- Grouping parts is used to increase the aggregated spend to help command a higher discount.

- Choose an achievable price point to entice suppliers to participate in the reverse auction. Or, set a reserved price: let the suppliers bid, but make it clear that if a particular cost is not achieved, there is no winner.

- Set a requirement that the winning supplier must be a qualified supplier, OR that cost gains must be a certain amount more than the cost of the qualification.

- If hosting an electronic reverse auction (also known as a reverse e-auction/online reverse auction), set up a flexible time limit. This is to prevent bidders from waiting until the last minute to bid.

- For example, if a buyer is set to conduct an auction for Lot A or part 123C234 from 10:00 a.m. to 10:10 a.m., the buyer should create a rule that states that if a bid comes in at the last minute, the time will automatically extend one minute, and so on, until there are no last-minute bids.

Take a Strategic Approach to Reverse Auctions

The popularity of reverse auctions has waned during the last 20 years because it was often used to reduce raw material and component prices to razor-thin margins and fray supplier relationships.

However, reverse auction strategies can be beneficial for buyers and sellers if they focus on the right supplier fit and include suppliers that are best suited to make the required parts. Proper tools and practices must be set in place beforehand to ensure successful reverse auctions.

IndustryWeek & aPriori: The State of Manufacturing Procurement

Access our report to see how manufacturers and suppliers are challenged and where they're advancing procurement.