The war in Ukraine and corresponding economic sanctions against Russia are tightening the supply of critical resources, shutting factories, and fueling inflation. And pressure from the private sector is cutting Soviet exports even further. Volkswagen and other global brands are closing factories in the region, Boeing is suspending orders for Russian titanium, and SWIFT is blocking some Russian banks from its financial network, which could prevent cash-strapped Russian suppliers from shipping goods.

This new chapter of supply chain instability requires executives to reevaluate their options quickly to maintain production and defend against margin pressure. Here’s how some companies are using manufacturing intelligence to identify immediate alternatives.

I. Mitigate Material Scarcity and Inflation Risks

A new wind turbine design includes four assemblies that require 101 tons of aluminum to meet annual production targets. But the aluminum distributor can no longer guarantee delivery of the full order and is increasing costs 35% to cover the pricing spike. Here are three ways to respond:

- Identify opportunities to replace materials without design changes. In this example, engineers used digital factories to simulate production using steel instead of aluminum – and identified that 11% of the SKUs have the high weight tolerances required to manufacture the components in steel. Automated digital factory design guidance alerts teams if a material substitution creates design for manufacturability (DFM) challenges – such as the need to use a different manufacturing process, tolerance issues, etc. For example, a hole that was punched may now need to be machined. Design engineers can also make non-invasive design modifications to enable production in a different factory. And to manage any revisions, engineers use the digital thread to collaborate with sourcing and manufacturing on design changes while maintaining a single source of truth from the design file (digital twin) through production.

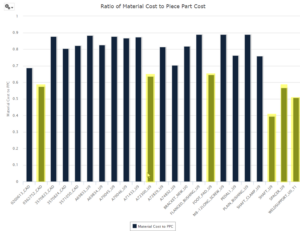

- Examine the ratio of material/piece-part cost. Breaking down material use by part improves planning and increases coordination and negotiation with your suppliers. When facing a surge in commodity prices or new tariffs, manufacturers can get the highest impact on cost by targeting SKUs with the highest ratio/percent of material. The figure below shows each SKU’s ratio of material cost to piece-part cost. Because aluminum accounts for a high percentage of total production cost for most SKUs, a price increase is justified in most cases. But there are some exceptions. Using this information, teams can negotiate a separate price for the SKUs made with a relatively low amount of aluminum. Identifying areas of cost avoidance can make a big difference for high-volume purchases.

Figure 1: Use the ratio of material cost to piece-part cost report to negotiate a lower price for the SKUs made with a low amount of aluminum (highlighted in yellow).

II. Identify Alternative Manufacturers

How long does it take your organization to evaluate the capacity of its corporate plants and contract manufacturers (CMs) – down to process for castings, machined parts, etc.? And how fast can your sourcing team evaluate the benefits and drawbacks of switching manufacturing to a new region? Consider the following three actions:

- Pinpoint capacity issues quickly. As a virtual representation of a physical factory, digital factories provide manufacturers with access to valuable design, sourcing, and planning capabilities. In addition to high-level factory capacity information, advanced manufacturing and supply chain planning teams need to see the process for each design alongside detailed production cycle time metrics. Teams use this information to determine the processes and number of machines required to meet production volume goals – and to identify capacity issues in near real time.

- Compare regional manufacturing costs. Even one supplier forced offline can leave a business scrambling to source hundreds of parts or produce complex assemblies within a tight timeline. With digital manufacturing simulation, product manufacturing teams evaluate other geographies based on sourcing costs in Brazil, Mexico, or other countries. Labor, overhead, and tool-shop rates are just some variables required to model costs and evaluate regional manufacturing options accurately.

- Use “should cost” analysis for effective supplier negotiations. Regional cost models use detailed economic data as the foundation for fact-based negotiations. Manufacturers and suppliers can use should cost information to focus on the reasons behind supplier cost outliers and work collaboratively to meet cost and deadline specifications. This may include identifying a design change, selecting an alternative material, or making an investment for tooling. By examining potential cost outliers, manufacturers can better understand suppliers’ capabilities and processes, and reduce negotiation cycles.

Figure 2: Analyze manufacturing costs by region.

III. Strengthen Resiliency through Analysis

It’s challenging to identify the weak points in a complex supply chain – especially when your suppliers’ suppliers can cause potential exposure. One manufacturer’s audit found that it was sourcing 60% of its components from a single supplier in the same region, according to a McKinsey report. It’s easy to assume that the manufacturer should have been aware of its reliance on a single region and supplier.

But the family tree of suppliers and their subsidiaries is continually growing new roots in some areas while paring back in others. The EMEA region alone had nearly 5,000 industrial manufacturing and automotive M&A deals in 2021, according to PwC. And the consulting firm projects an uptick in M&A activities in these industries this year.

Solutions from aPriori enable companies to run multi-dimensional reports to:

- Identify an overreliance on production in a specific geography

- Find alternative global regions to source parts when factories or shipping routes close in other countries

- Evaluate other manufacturing methods to use suppliers with different capabilities to make parts

- Classify parts by manufacturing process to work effectively with relevant suppliers

- Reduce the number of SKUs through consolidation and redesign to cut cost and supply chain complexity

Speed: A Key to Supply Chain Availability

Product development and manufacturing teams need the intelligence to make supply chain decisions quickly and accurately. But insight without action can still cause manufacturers to fall behind. As an example, there is a big gap between identifying a new supplier and getting the supplier up and running rapidly.

Manufacturers that embed analysis and agility into their operations have the speed and confidence required to take bold steps in the face of sudden supply chain disruptions.

Learn how aPriori can help you develop products faster, reduce cost, and mitigate risk.