Key Takeaways:

- Use our seven-step process to conduct a detailed spend analysis

- Take advantage of our tips for procurement teams to unlock additional savings

The Full Article:

Conducting a spend analysis is an essential cost-saving component in any business, and it’s especially important in the manufacturing industry. We can’t fully consider cost-saving opportunities until we have visibility into our product manufacturing spend today.

Experienced procurement and sourcing managers who conduct a spend analysis to meet product cost reduction goals typically achieve savings of 3 to 5% of the spend analyzed.

Procurement teams that achieve optimum savings have a robust strategic sourcing process to review material and component spend categories to meet product cost reduction goals. This includes working through each manufacturing process to identify outliers, analyze those outliers, and execute cost-reduction plans.

This post defines the spend analysis methodology for manufacturers. And it also outlines how procurement teams can use detailed spend analytics to capture cost savings and advance strategic sourcing to help increase profitability.

What Is a Spend Analysis in Manufacturing?

A spend analysis is the process of collecting, cleansing, classifying, and analyzing spend data. The result? Cut procurement costs, improve efficiency, enhance supply chain management, and monitor controls and compliance.

Manufacturers use a spend analysis to review all of their purchases and identify the biggest opportunities to save time and money by renegotiating costs with suppliers or redesigning products.

As a sourcing manager, the primary driver for conducting a spend analysis is to meet your cost-reduction goals. A spend analysis helps you achieve those goals by identifying cost outliers – the most promising parts on which to focus your cost reduction efforts.

After conducting a manufacturing spend analysis, you should be able to identify:

- The specific parts for which you may be overpaying for and an estimate of how much

- Products that could be redesigned for cost reduction

- Items that are not being made in the most cost-effective manner, i.e., via the most cost-effective routing or process

- The number of suppliers that may be a better fit for the parts that you are buying

The Manufacturing Spend Analysis Methodology

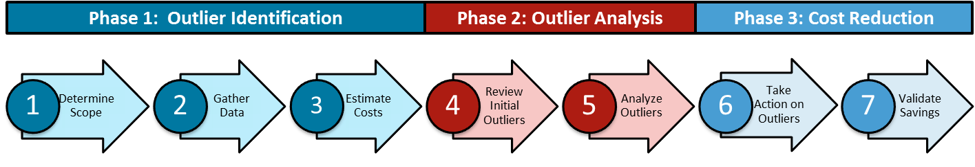

We recommend the following methodology for a procurement spend analysis, which has three phases and seven main steps.

Phase I: Identify Outliers — Spend and Sourcing Analysis

A standard product cost outlier is a part for which the price difference between what your product cost management platform estimates it should cost and what you pay is between 25% to 40%. Identifying these products is the core of phase one of the manufacturing spend analysis and spend management process.

1. How to Determine Spend Analysis Scope

You likely have thousands of parts that you buy and simply cannot examine all of them at once. That’s why it’s important to narrow down the scope of what you’re going to analyze.

- Procurement teams start by segmenting your spend into manufacturing process groups, such as sheet metal or casting parts. And then further categorize by material. You may not be able to find out what material your parts are made out of until you look at the actual 2D drawings or PDFs. But if you can, segment by material at this stage.

- Next, go to your ERP system and get the current price that you’re paying for the part and the estimated volume for each part annually. Multiply the two to figure out how much you spend on each one of these parts.EQUATION: Current Price of Part x Estimated Volume of Part = Product Spend.

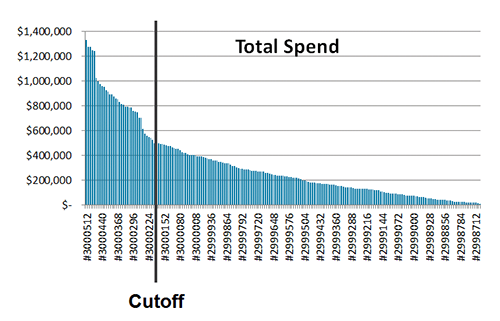

- Then add the total spend to a Pareto chart with all of the parts that you are analyzing. Once your parts are in your chart, select the top 50, 100, or 200 parts to analyze. It’s up to you where you make the cutoff, but you want to prioritize based on the highest annual procurement spend.

The Pareto chart shows the top 100 products by total product cost. Additionally, business intelligence tools, including aP Generate, provide a dashboard view of product cost outliers at scale.

2. Gather Important Spend Analysis Data

Once you have narrowed the scope down to your top 50 to 100 parts, begin to obtain the data for these parts. Data to gather includes:

- 3D CAD models

- 2D drawings, usually in PDF format, which may contain data not found on the model (such as material type or secondary processes required, and tight tolerances)

- The actual or estimated annual production volume for each part

- And the estimated batch size. If you don’t have the batch size, then use the order size from your ERP system

If you were not able to segment by material type when determining your scope, having gathered the 2D drawings, you may now be able to do so.

PRO TIP: You also want to collect the current cost or quote for later comparison, the manufacturing process used to make the part today (if known), and the name of the supplier making the part. You will need to know which supplier is making the part if you want to do some extended trend analysis later.

In addition, you will want to know the location where you’re buying the part. When you generate the estimated cost, make sure that you don’t compare the cost of a part that you buy in China, for example, to an estimated cost of making that part in the U.S., for example.

3. Estimate Should Costs and Identify Outliers

At this point, you’ve determined your scope of review and gathered your important data pieces.

The next step, and one of the most critical, is to estimate the costs of your 100 parts. You can do this with whatever tool you have available. Whether that is a set of complex Excel spreadsheets or real-time manufacturing cost estimating software, such as aPriori.

PRO TIP: Use automation to save time on your estimates! A manufacturing insights platform enables manufacturers to optimize products for cost, sustainability, and manufacturability simultaneously. One feature – commonly referred to as cost / spend analysis software – uses both global and highly localized product cost inputs to help businesses estimate the should cost of their products.

Using aPriori’s automated insights, manufacturers have the visibility to optimize each step of the product process to capture additional savings, reduce carbon emissions, and address supply chain risks proactively. And it does so at a fraction of the time of custom spreadsheets. aPriori ensures that you have actionable insights to improve your cost-based decision-making.

Once you have estimated the cost of your parts, you will be able to identify the outliers by conducting a should cost analysis. A should cost analysis is an exercise in comparing your should cost estimate to what you’re actually paying and then identifying parts where the gap is significant.

Across all industries, a standard product cost outlier is a part for which the price difference between what your product cost management platform estimates it should cost and what you pay is between 25% to 40%.

However, your outlier percentage may be different. I recommend that you calculate the annual potential savings (potential savings multiplied by annual volume) per part and make your prioritization based on that figure.

Phase II: Outlier Analysis

The next phase involves reviewing the outliers you have identified and beginning to select those where you have cost-saving and negotiating opportunities.

4. Review Initial Outliers

After identifying your initial outliers, which may be 20-25 out of your original scope of about 100 parts, you want to re-review the estimate for each part to ensure you have accurately forecasted the product cost.

This is an important step because you don’t want to move forward with the next steps if the data that you have is not valid.

If the gap is significant, meaning the estimate is 3 to 4x lower than what you’re paying, this is an especially critical step. Spend time reviewing your selected materials, volumes, manufacturing processes, etc. For example, are you including the cost of shipping?

5. Analyze Your Outliers and Make a Plan

After confirming the estimates were calculated correctly, analyze your remaining outliers in detail to determine the best possible method for cost savings and develop an action plan for each of them.

There are two key areas of outlier analysis: Redesign and Renegotiation.

Identifying Candidates for Redesign

To identify candidates that may be a good fit for a redesign for cost savings, first plot the estimated cost of each part divided by its weight. Why use weight? Because heavier parts often have the greatest redesign or cost-saving potential.

EQUATION: Estimated Cost/Product Weight = X

Weight may be obtained from your cost estimating software, the CAD system if density is available to it, or the estimated shipping weight from your ERP.

Plot these points on a scatter plot. You may notice that your scatter plot aligns into a straight line. Identify the parts for which the ratio of weight to estimated cost is very high relative to the rest. This is an indication that the part is complex or has high tolerance requirements.

As you plot, be sure to prioritize candidates for supplier discussion, based on the highest annual spend or greatest savings opportunity. Learn more about how to frame your supplier collaboration.

Identifying Candidates for Renegotiation

If the difference between your current cost and your estimated cost is significant, say 20% or more, then a discussion, regarding how the supplier arrived at that price is in order.

Key areas where you may see cost negotiation opportunities are:

- Material costs

- Tooling costs

- Manufacturing routing techniques

- Supply base

Develop a list of questions that can be used for supplier negotiation/collaboration. For tips on collaborating with your supplier using fact-based negotiation, read this article.

Phase III: Cost Reduction

6. Take Action

Once you have finished your analysis of the outliers, it’s time to do something about it.

For Redesign Opportunities:

Take the part that you want to redesign, or want to explore a redesign of, and go to engineering to discuss redesign and cost-saving potential. Alternatively, you can talk to your suppliers to see if the part can be redesigned to better fit with the manufacturing process.

PRO TIP: I will tell you from personal experience, if you go to your suppliers and simply ask them for ideas on how to save money on all the parts they make for you, you may get general suggestions that are very seldom worth pursuing. However, if you do the work to run an informed spend analysis and then go to your supplier and say, “Hey, I have one or two parts that I think there is an opportunity for us to collaborate on to make it cheaper,” they will be very happy to look at those one or two parts in detail and give you targeted suggestions for reducing costs. This has been a worthwhile exercise for many of our customers.

For Renegotiation Opportunities:

If the part is simply too expensive, you have to develop a plan for how to approach the supplier based on the data from the analysis and then renegotiate the expensive costs with the supplier. There may be opportunities to save in areas like expensive premiums or tooling, even if the product can’t be redesigned to save.

7. Validate Your Savings

Finally, you want to validate your savings. See if what you estimated as potential savings (the difference between your should cost estimate and what you were actually paying) was actually realized, and how much was realized. Further, you can leverage mutually beneficial, fact-based cost data to enhance supplier relationships and score cost-saving wins during negotiations.

Does this really work? Yes, it does.

As an example, we worked with a $6.5B manufacturer and supplier of commercial trucks, parts, and diesel engines. They wanted to accelerate the achievement of annual cost-reduction goals. We analyzed €7.7M euros in spend across 86 sheet metal parts. Seventeen of the 86 parts turned out to be outliers. At the end of the exercise, the manufacturer had confirmed savings of €1.6M euros, which was 20% of the spend analyzed.

Strategic Sourcing Optimization for Cost Transformation

A robust sourcing strategy requires more than a spend analysis to identify costs. It also requires a should cost analysis to identify cost outliers, which can help sourcing teams prioritize components and raw materials that require additional investigation and negotiation to secure lower prices. But for true cost transformation that will have staying power, procurement needs a solution that drills down to the highest component cost drains.

Want to learn more? Read our Guide to Manufacturing Cost Estimation.

DISCOVER HOW TO RISK-PROOF YOUR SUPPLY CHAIN

Learn how to use data to mitigate the cost of disruptions and turn supply chain resiliency into a competitive advantage.