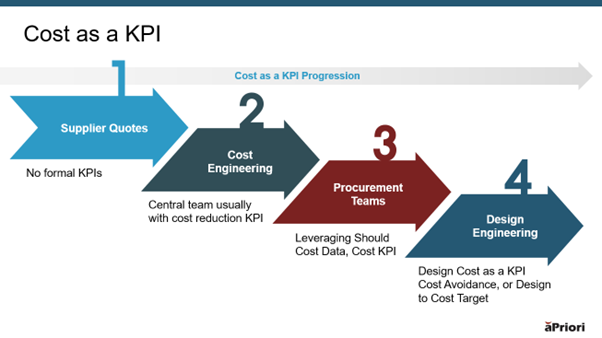

How Cost As A Key Performance Indicator (KPI) Impacts An Organization

Key Takeaways:

- Many organizations struggle to get a handle on expenditures and often fall short on identifying the liabilities that impact the bottom line

- Using cost as a key performance indicator (kpi) can provide myriad benefits, such as risk reduction, more profitability, and faster time to market, to organizations, and those who automate it achieve a faster return on investment and greater agility and competitiveness

The Full Article

Cost is a major priority for any organization. The earlier an organization can manage it, the better.

However, it shouldn’t be an ad hoc approach. It requires one that streamlines cost reduction, improves cash flow, more accurately forecasts costs, facilitates better decision-making, provides a return on investment, and boosts overall financial health. The solution? Use KPIs.

The Benefits of Cost as A KPI

Cost as a KPI is valuable in maintaining a competitive advantage. It is a direct measure of an organization’s financial health and operational efficiency. Tracking such cost-related metrics, including customer acquisition cost, cost of goods sold (COGS), and/or operational expenses, can help companies identify areas of waste, negotiate more effectively with their suppliers, and improve processes.

A strong, closely monitored cost as a KPI strategy ensures more accurate budgeting and forecasting to support more strategic decision-making and greater financial health.

Here are additional benefits:

- Early Cost Influence: The vast majority of a product’s lifecycle cost (upwards of 70-80%) is determined during the early design phases. Higher cost maturity allows for greater influence over these costs.

- Reduced Risk: Better cost predictability and control reduce financial risks associated with new product introductions.

- Improved Profitability: Optimizing costs directly impacts profit margins, allowing for competitive pricing or higher returns.

- Faster Time-to-Market: Efficient cost management processes can reduce rework and delays, accelerating product development cycles.

- Enhanced Innovation: By understanding cost drivers, companies can innovate within cost targets, fostering creative solutions.

For discrete manufactured products, obtaining and refining cost figures is a dynamic process that evolves significantly as a company’s cost maturity increases. Here’s a breakdown of how and when cost figures are typically generated, and how this changes with maturity:

How and When Companies Get Cost Figures (by Stage and KPI)

Level 1: Reactive / Ad-hoc Cost Management

- How:

- Expert Judgment/Historical Analogies (informal): Rely heavily on the experience of senior engineers, purchasing managers, or other staff who might recall similar past products. This is often an unscientific “gut feeling.”

- Vendor Quotes (late stage): Costs are primarily determined by soliciting quotes from suppliers once a design is largely finalized. There’s little room for negotiation or design changes based on cost.

- Simple Bill of Material (BOM) Summation: A basic list of components is created, and known or estimated prices are added up. Manufacturing costs (labor, overhead) are often a rough percentage or afterthought.

- When:

- Late in Design: Cost consideration usually begins seriously only when a prototype is being considered or after a design is largely complete.

- During Production Setup: The true cost is often only realized once production has begun, leading to reactive price adjustments or profit sacrifices.

Level 2: Basic / Repeatable Cost Management

- How:

- Formalized Analogous Estimating: More structured use of historical data from past, similar projects. Spreadsheets of past project costs might be maintained, though perhaps inconsistently.

- Preliminary BOM Analysis: Components are listed with more effort to get preliminary quotes or catalog prices. Some basic internal labor and overhead rates might be applied.

- Simple Parametric Models: For very basic components or processes, simple rules-of-thumb might be used (e.g., “plastic part cost is $X per gram” and/or “material is 80%, process is 20%”).

- When:

- Early Design (rough estimates): Some initial cost targets might be set, but they are often high-level and subject to significant change.

- Design Freeze: More detailed cost estimates are often made once the design is somewhat stable, before significant tooling investment.

- RFQ (Request for Quote) Stage: Formal RFQs are sent to multiple suppliers to get competitive bids.

Level 3a: Defined / Standardized Cost Management

- How:

- Detailed Bottom-Up Estimating: This becomes the norm. Each component, sub-assembly, and manufacturing operation is broken down and estimated. This includes:

- Material Costs: Detailed analysis of raw material types, quantities, scrap rates, and market prices.

- Component Costs: Leveraging existing supplier relationships, analyzing competitive quotes, and starting to build “should-cost” models for purchased parts.

- Labor Costs: Applying standard times for each operation (assembly, machining, finishing) and applying labor rates (direct and indirect).

- Overhead Allocation: More sophisticated methods for allocating manufacturing overhead (utilities, rent, depreciation) to specific products.

- Tooling & Capital Costs: Understanding the non-recurring engineering (NRE) costs for new molds, dies, fixtures, and specialized equipment.

- Target Costing: A desired selling price and profit margin lead to a target cost, and the design team actively works to meet this target.

- Design for Manufacturability (DFM) / Design for Assembly (DFA): Engineers actively design products to minimize manufacturing complexity and assembly time, which directly impacts cost.

- Preliminary Should-Cost Modelling: Initial attempts to build models of what a product should cost, based on raw material prices, processing times, and efficient manufacturing practices, even before engaging suppliers.

- Detailed Bottom-Up Estimating: This becomes the norm. Each component, sub-assembly, and manufacturing operation is broken down and estimated. This includes:

- When:

- Concept / Feasibility Phase: Rough estimates are generated to assess viability.

- Preliminary Design Review: More detailed estimates are available to influence design choices and ensure the project is on track for cost targets.

- Critical Design Review: Highly refined cost estimates are presented, often with committed supplier quotes, before moving into production tooling.

Level 3b: Managed / Quantitatively Controlled Cost Management

- How:

- Advanced Should-Cost Modelling: Sophisticated software tools and databases are used to build highly accurate “should-cost” models, often based on 3D CAD data, simulating manufacturing processes (machining, molding, stamping, etc.) and material utilization. This allows them to challenge supplier quotes effectively.

- Value Engineering (VE): Dedicated teams analyze product functions and identify ways to achieve the same function at a lower cost, often by optimizing materials, processes, or design.

- Lifecycle Costing (LCC): Beyond manufacturing cost, the company considers the total cost of ownership, including service, maintenance, spares, and end-of-life costs.

- Integrated Cost Engineering Tools: Costing is embedded within the product lifecycle management (PLM) and enterprise resource planning (ERP) systems, allowing for real-time cost updates and analysis.

- Scenario Analysis and Sensitivity Testing: Modelling the impact of changes in material prices, labor rates, production volumes, or design variations on the overall cost.

- When:

- Very Early Design (Ideation/Concept): Cost is a primary driver from the outset, influencing basic architecture and technology choices.

- Continuous Monitoring: Cost performance is tracked against targets throughout development and into production, with deviations triggering immediate analysis and corrective action.

- Supplier Negotiations: “Should-cost” models are used as a powerful negotiation tool with suppliers to secure favorable pricing.

Level 4: Optimized / Continuous Improvement Cost Management

- How:

- Predictive Cost Analytics: Leveraging data on historical products and projects to predict costs with high accuracy, even for novel designs.

- Proactive Cost Avoidance: Identifying potential cost escalations before they occur through advanced risk analysis and mitigation strategies.

- Total Value Chain Optimization: Collaborating deeply with suppliers and customers to optimize costs across the entire value chain, not just internal operations. This might involve joint development programs or shared cost-saving initiatives, such as Zero RFQ.

- Cost-Conscious Culture: Cost management is deeply embedded in the organizational culture, with all employees, from design to procurement, understanding their role in cost optimization.

- Strategic Sourcing & Category Management: Long-term relationships with key suppliers, strategic purchasing decisions, and leveraging global supply networks to secure optimal pricing and innovation.

- When:

- Strategic Planning & Portfolio Management: Cost implications are considered at the highest levels of strategic planning, influencing which products are developed and what markets are targeted.

- Throughout the Product Life Cycle: Cost optimization is an ongoing process, even for mature products, through continuous improvement initiatives and re-evaluation of the bill of materials and manufacturing processes.

- Agile Feedback: Collaborative feedback from manufacturing, cost engineering, procurement, and any other stakeholders informs designs to continually reduce costs.

From Reactive Quotes to Proactive Design-For-Cost Methodologies

In essence, as companies mature in cost management, the “how” shifts from intuition and reactive quotes to sophisticated, data-driven analysis and proactive design-for-cost methodologies. The “when” moves from late-stage realization to early and continuous integration throughout the entire product development process, viewing cost as a critical design parameter from day one.

Moving through these levels requires a commitment to process improvement, investment in tools and technologies, development of skilled personnel (cost engineers, analysts), and strong cross-functional collaboration.

How Accurate Are Your Product Cost Projections?

See how simulation-driven analysis connects design decisions with key cost drivers, empowering you to identify savings opportunities and streamline supplier negotiations

More Resources:

- Blog: Top 3 Manufacturing KPIs Every Cost Engineer Should Know

- Case Study Video: Mastering Should Cost Modeling: GE Appliances’ Journey Unveiled

- Webinar: Beyond Spreadsheets: Dramatically Reduce Costs with Automated Should-Cost Analysis | aPriori

- Podcast: Podcast | Database Technology to Improve Financial KPIs