What’s Lurking Behind Your Missed Margin Targets? Product Cost Creep

Key Takeaways:

- Cost creep starts early in product design—and becomes almost impossible to undo later when products are in production

- Cost creep is a major reason why companies miss product gross margin targets and why they spend so much effort on margin expansion programs

- Cost creep is usually systemic, not accidental, and driven by fragmented cost ownership, lack of cost ownership, late validation, and teams optimizing independently without a shared, real-time view of cost impact across the lifecycle

- Prevention requires embedded cost intelligence automation—not more manual work

The Full Article

Product Cost Creep: Major Causes & Mitigation Plans

Product cost creep is one of the most persistent and damaging challenges manufacturers face. It is the root cause and a major reason why products miss gross margin targets. Gross margin targets are typically set early, based on high-level cost assumptions made during concept or business case development. Those assumptions rarely match reality.

As the product moves from concept to production, cost creep quietly accumulates through design decisions, complexity, late changes, and manufacturing inefficiencies. By Standard Operating Procedure (SOP), the actual unit cost is materially higher than planned—often by 5–20% or more—while pricing is already committed or constrained by the market. At that point, margin loss is effectively “baked in.”

Up to 90% of a product’s total cost is effectively locked in by the end of detailed design, meaning the biggest cost decisions are made long before sourcing or production begins. Programs often begin with well-defined cost targets, yet by the time products reach production, those targets have quietly slipped as cost increases—margins have narrowed, launches have been delayed, and painful trade-offs have been forced.

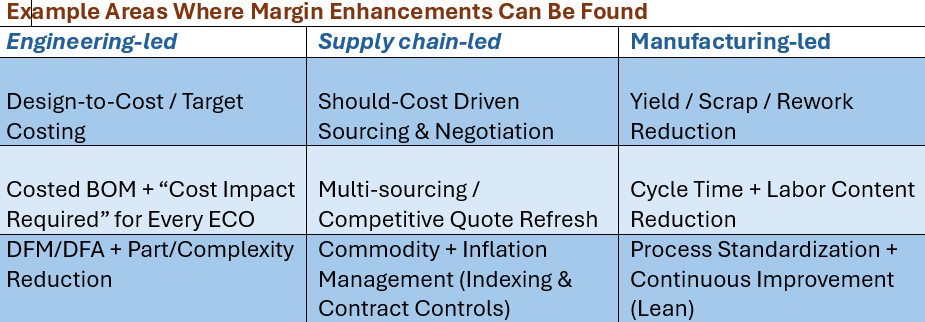

Margin Expansion Programs: Proactive or Reactive?

Most corporate margin expansion programs are not about strategic growth—they are reactive recovery efforts. They exist for three main reasons: (1) products were launched with structural cost disadvantages, (2) engineering decisions were committed too early, and (3) fixes were deferred until after the start of production. As a result, companies must look for margin enhancements in other areas, including:

Margin expansion programs exist because cost was not managed when it was most controllable—during design. Cost creep creates structural margin gaps that are difficult to close once products are in production.

As a result, margin expansion is not as much a necessity as it is a symptom of upstream cost management failure.

Cost Creep: An Underestimated Margin Eroder

Cost creep is one of the most underestimated and obscure reasons why companies miss margin targets. But there is a way to mitigate this and solve it: automating cost intelligence into the product development process. The key is to start early in the design stage and straight through production.

Cost creep rarely comes from a single bad decision. Instead, it’s the cumulative result of many reasonable decisions made across the product lifecycle, often without clear cost visibility. Examples include engineering changes well into product development, a shift in supplier materials or parts, and more complex parts production. These examples, and others like them, lead to margin erosion.

Margin erosion is exactly as described. It eats away at profits over time. Cost creep is a major factor in margin erosion. Product costs increase throughout product development while profit margins simultaneously decrease. The most unsettling part is that this erosion often goes unnoticed until it’s too late to reverse course.

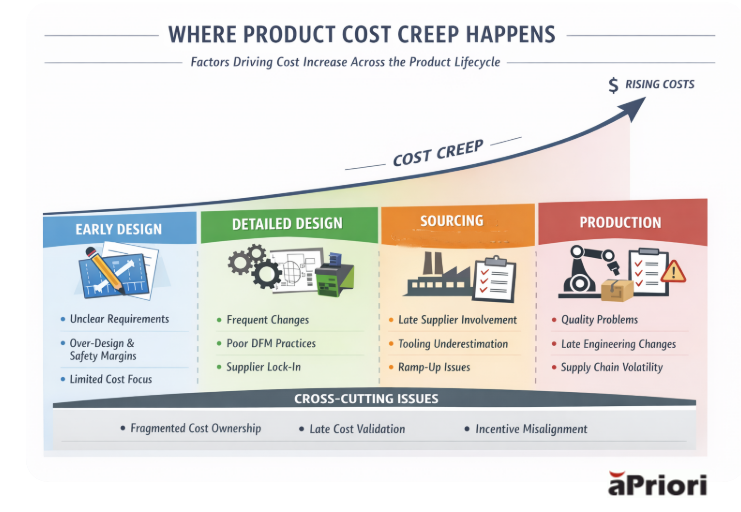

Where Product Cost Creep Happens Across the Lifecycle

Although most spending occurs during production, the majority of a product’s cost is committed much earlier. By the time detailed design is complete, up to 90% of the total cost has effectively been locked in, leaving teams with limited flexibility to correct course and with a reactive rather than proactive response.

Understanding how cost creep builds at each stage is critical to preventing it.

Early Design: Cost Is Locked In Before Anyone Sees It

In the earliest phases of development, uncertainty is high, and requirements are still evolving. Engineering teams naturally focus on meeting performance targets and reducing technical risk.

Working from spreadsheets like Excel and relying on historical data further complicates the issue. Engineers and commodity managers do not have time to manually calculate costs, let alone ensure their accuracy. Without reliable cost feedback, designs often include excess material, conservative tolerances, and safety margins that feel prudent at the time.

These early decisions rarely trigger alarms because their cost impact isn’t immediately visible. However, once embedded in the product architecture, they become difficult—and expensive—to remove later.

Detailed Design: Complexity and Change Accelerate Cost Growth

As designs mature, cost creep accelerates due to frequent engineering changes driven by testing issues, evolving requirements, and feature creep, where incremental additions beyond the original scope increase complexity. Designs optimized for function over manufacturability, along with early component and material choices, constrain sourcing flexibility and quietly drive costs higher. Even small changes can ripple through tooling, suppliers, and manufacturing processes, increasing both recurring and non-recurring costs as added complexity demands new tooling, requotes, and process adjustments.

Sourcing: Too Late for Easy Fixes

Many organizations wait until sourcing or production to address costs, but by then, design decisions are largely frozen, limiting the availability of easy fixes. Supplier input arrives too late to influence architecture, tooling costs are higher than expected, and production ramp-up reveals inefficiencies not apparent on paper. Midstream supplier changes or alternate sourcing introduce delays due to requoting. What could have been optimized during design now requires negotiation, price or schedule compromises, or simply accepting higher costs.

Production: The Most Expensive Place to Learn

When cost issues surface in production, they are no longer theoretical. Scope creep can expand requirements or volumes after work has begun without updating costs, timelines, tooling, suppliers, or quality plans. Added inspections, testing, or certifications slow launches and drive cost creep, while quality issues, late engineering changes, and supply chain volatility directly erode margins and delivery performance. At this stage, changes are costly, disruptive, and often unavoidable, leaving teams focused on damage control rather than prevention or cost savings.

Example of Scope Creep

You start producing a bracket with a standard tolerance. Halfway through production, someone asks for a tighter tolerance, new surface finish, and a second inspection step. Those requests can force a new machining strategy and add cycle time and extra inspection costs, even if the part looks nearly identical to the original design.

Example of Features Creep

A product starts as a basic metal enclosure. Subsequently, other features are requested, such as extra mounting brackets, a custom finish, tighter tolerances, added sensors and wiring, and multiple regional variants. Each one seems small, but together they can significantly increase manufacturing cost and complexity.

The Systemic Problem Behind Cost Creep

Across all lifecycle stages, cost creep is reinforced by organizational dynamics. Cost ownership is fragmented across engineering, sourcing, procurement, and manufacturing. Cost validation happens too late. Incentives encourage local optimization rather than total lifecycle performance.

The result is predictable—and repeatable—across industries.

Mitigating Product Cost Creep Requires a Shifting Cost Intelligence Earlier

Leading manufacturers prevent cost creep by making cost a design input, not a downstream outcome. They bring cost, manufacturability, and sourcing insights into engineering decisions, while maintaining high flexibility and low-cost change. To do so, they need:

- Roadmap: Clear requirements and change control

- Analysis: Design reviews focused on manufacturability (DFM/DFA)

- Metrics: Cost impact checks for every new feature

- Prioritization: Using a “must-have vs nice-to-have” priority list

Gaining cost intelligence requires more than spreadsheets and historical averages. It requires a shift in how costs are identified at the onset of product development. By moving manufacturing and cost decisions earlier in the product development cycle, engineers can optimize designs for cost, manufacturability, sourcing, and sustainability before designs are finalized and expensive changes are required.

But it requires accurate, product-specific cost intelligence early in the lifecycle. aPriori enables “early visibility” by giving engineering and sourcing teams rapid, design-driven insights (e.g., cost breakdowns, manufacturability risks, and supplier/process comparisons) directly and automatically from CAD and product data—helping teams make better decisions upstream and reduce late-stage redesigns, delays, and cost overruns.

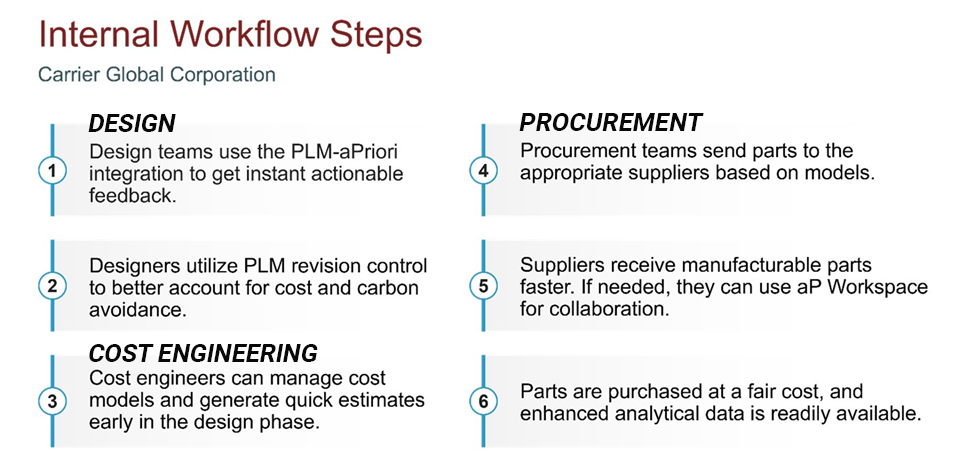

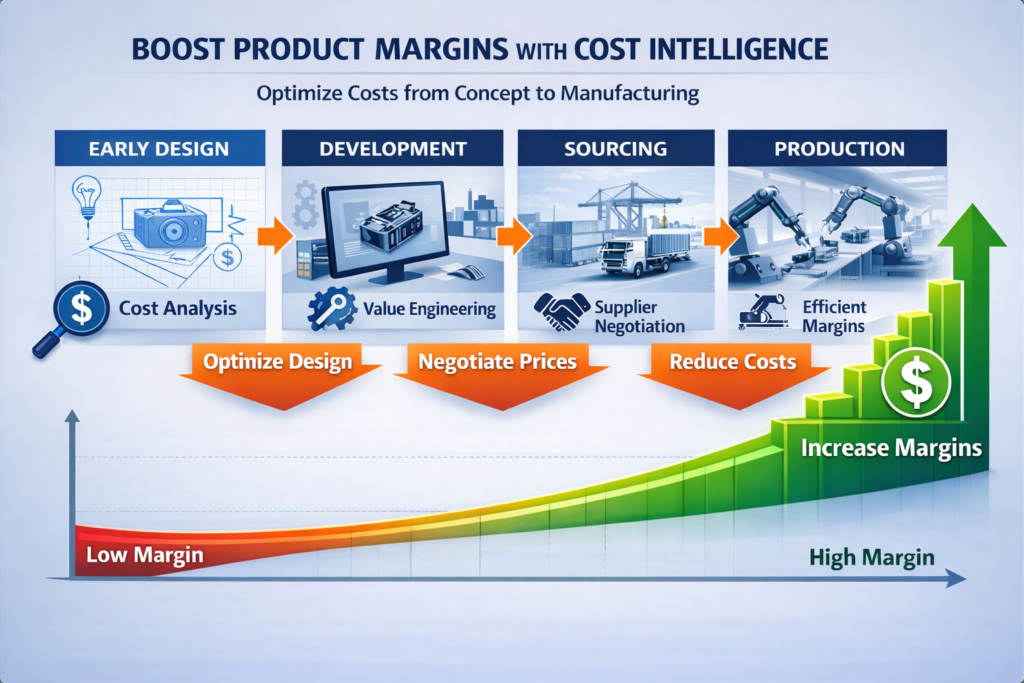

Figure 3: Internal workflow steps are achieved using digital factories. Leveraging aPriori for digital factories, Carrier was able to obtain accurate cost models on complex products in a matter of minutes at all stages of product development. aPriori enables manufacturers to identify and eliminate cost creep at its source—during design—continuously updating costs as the design changes. By embedding digital manufacturing intelligence directly into engineering workflows, aPriori gives teams early and continuous visibility into the cost impact of their decisions. Engineers can evaluate materials, processes, tolerances, and manufacturing strategies in real time. Sourcing teams gain insight before supplier engagement. Manufacturing teams see risks before designs are finalized. Everyone works from a shared, data-driven view of cost as well as a unified narrative, complete with the right cost language. Instead of reacting to cost overruns late in the lifecycle, manufacturers using aPriori prevent them altogether and streamline product development in the process. Figure 4: Cost creep can be avoided and margins enhanced across all stages of product development with cost intelligence. Product cost creep is not inevitable. It is a symptom of late visibility and disconnected decision-making. By shifting cost insight left and aligning teams early, manufacturers can protect margins, reduce risk, and deliver products that meet both performance and cost targets—from concept through production. Shifting left only works if teams get instant, continuously updating cost feedback from CAD, directly inside existing workflows—creating a shared, automated cost language across functions and product development teams (engineering, sourcing, manufacturing). aPriori is more than an analytics tool. It provides an infrastructure for scalable design to cost. Manufacturers committed to optimizing and accelerating product development, ensuring profitability, and remaining agile and competitive need a solution like aPriori. By reducing product cost creep, a manufacturer can improve its value proposition. As a result, it can be more competitive on price, scale faster and more efficiently, leverage data for greater transparency and predictability, and provide a higher-quality product with less risk.

How aPriori Helps Manufacturers Stop Cost Creep Before It Starts

aPriori Helps Turn Cost Problems Into A Competitive Advantage

Costs Spiraling Out of Control? Get Our Report

Achieve immediate cost savings without sacrificing long-term growth. Our strategic report for global manufacturing executives offers effective cost-transformation strategies.